It can be confusing to decide how to start trading online. One can choose among forex, crypto, CFDs or binary brokers from all over the world. Also, traders can’t only click and make profit, as they need to learn more about financial analysis and trading strategies. In this guide, we will try to present you with most common dilemmas and questions that are bothering not only new traders who are only starting, but also more experienced traders. The point of this binary options and forex guide is to get a sense of what the trading is about and to encounter some basic terms one uses when trading.

Alnother useful resource is our Forex trading basics guide and our online trading academy with more than 150 articles – from basic terminology to advanced trading strategies and patterns.

First, it is important to understand the basic differences between different types of online trading.

What is Forex Trading?

Forex trading is somewhat different than binary trading, even though traders don’t have to own the underlying asset. Forex trading is based on currency pairs (for example, EURUSD – see how to trade this pair) and traders can buy or sell the desired amount of currency contracts and use leverage to move larger amounts of money. Also, traders have different risk management tools like stop loss and take profit at their disposal.

Forex trading is somewhat different than binary trading, even though traders don’t have to own the underlying asset. Forex trading is based on currency pairs (for example, EURUSD – see how to trade this pair) and traders can buy or sell the desired amount of currency contracts and use leverage to move larger amounts of money. Also, traders have different risk management tools like stop loss and take profit at their disposal.

What is Binary Options Trading?

Binary options are a special type of financial instrument that allows traders to know possible payout in advance. At the same time, traders never own the asset in order to trade based on it. They are placing a trade based on their prediction of the price movement and not based on buying or selling the actual asset. European market oversight agency ESMA decided to temporarily ban binary options (PDF) distribution and sales to retail investors for 3 months in 2018 since they felt this instrument design might present too big a risk for small traders.

What is CFDs Trading?

CFDs trading is very similar to forex trading, but the underlying asset is different. Contracts for difference are based on bonds, stocks, commodities etc. Most modern brokers offer forex and CFDs trading at the same time. We have also explained CFDs in our trading guide on forex.

What is Cryptocurrencies Trading?

Cryptocurrencies trading is the latest trend, based on digital coins or tokens that appeared on the market some 10 years ago. Traders can trade them as CFDs and forex contracts with regulated brokers (the safest option) or via crypto exchanges (riskier option). We have written a comprehensive guide for cryptocurrencies trading you should read. Also make sure to check out how to take advantage of Bitcoin CFDs, the first and most popular cryptocurrency to date.

Binary Options Guide for Dummies

The idea behind binary options is indeed one of simplicity, however, there are some general rules one has to know in order to be able to run the trading platform and become successful. Pushing Up/Down or Put/call will not be helpful unless tied to a serious understanding of the market.

Online Trading Dictionary – Options Trading for Beginners

Expiration Date: The time that the option expires.

Settlement Value: The value of the option on expiration.

Underlying Market Price: The actual real-time market price of the contract.

Bid: The premium price that traders pay for an opening to sell a contract or closing a buy order.

Ask: The premium price that traders pay for an opening to buy a position. This is essentially anticipating that the underlying market price will go up. It is the price paid by a trader who has an open position to sell and wants to close it out.

Spread: The difference between the bid and ask.

Bid size/Offer size: This reflects the number of positions being bought or sold.

Commission fee: The trader will pay a commission fee per transaction – more common in CFDs and forex trading, binary options do not require commissions.

Set-and-let: When you take a position and do not trade in the same market until the time frame expires and the bet is settled.

ROI: Return on Investment

Sell: The action used in forex and CFDs trading when traders believe the price won’t move in their favor. The opposite is “Buy”

High: if you believe the price of an underlying asset will rise, you click “High” in the trading platform

Low: if you believe the price will fall in the future, use this price direction to indicate which way the binary option should move.

Strike Price and the Underlying Market Price – what is the relation?

All beginners should understand these basic terms, whether they are binary options beginners or only starting in forex and CFDs.

All beginners should understand these basic terms, whether they are binary options beginners or only starting in forex and CFDs.

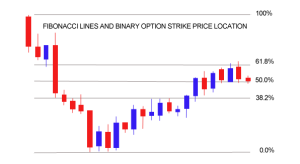

The strike price is the price in the moment when the trader places the trading order. This is the price at which the option or CFD are executed. In case of binary options, if you expect the price of the underlying asset to rise, the price of the asset at the moment of expiry of the option must be higher than the strike price. This is called “in the money”. See how to decide the strike price with simple trend lines.

In case you were wrong, and the price is lower than the strike price – the option closed out of the money and you lost your investment.

Underlying market price is the price you are watching after the trade has been placed and, as explained, its relation to the strike price determines the outcome.

With binary options the returns in case of successful prediction can be high and it helps that they are fixed, but understand that in case of the unsuccessful trade, all money wagered is lost. Its different with CFDs, there the amount one wins or loses depends on the difference between the strike price and the market price at the time when the trade is closed. This is why these are called “contracts for difference” after all.

What are Fixed Price Options and No Touch Options?

The fixed price options are used for trading out the assets at a specific strike price. This means that the trade is being placed in the moment when the underlying market price reaches certain level which becomes the strike price for the option.

The fixed price options are used for trading out the assets at a specific strike price. This means that the trade is being placed in the moment when the underlying market price reaches certain level which becomes the strike price for the option.

No-Touch Options are one of the most popular binary options and are considered to be somewhat riskier as traders will have to predict not just the direction of the price but the possible range it will (not) reach. This options type is extremely useful for traders who believe that the underlying asset price will increase over the range-bound during a specific time frame as they will end up making a lot of money if they are right.

Can I Make Money with Binary Options or Forex?

Binary options trading should not be taken as a risk-free way of trading online no matter what some brokers might say. There is always some risk linked to the process, but it does not mean that one cannot reduce the risk by employing smart strategies or trading responsibly.

Some of our other articles on recognizing danger to your money and properly trading online:

If traders think the price of gold is going to rise, then they place what is called a call binary option. For this reason, they would need to select the assets they have, in this case being the gold. The next phase would be determined by what trend the asset is going to show i.e. up or down. The last phase is that they determine the amount they are going to invest in it. If things go as planned with the price of gold, they stand to earn up to 100% returns, sometimes even more. If the trade goes sour – they lose the invested capital.

On the other hand, if they feel that the price for the gold is going to decline, then they place what is called a put option. If the same happens as before, they will yet stand to earn even from the falling prices. The entire process can take place in minutes as well hours depending upon the expiry time they chose. But as a trader and an investor, one should exercise caution in all the steps taking in this regard, as they can also end up losing all their investment.

Binary Trading with Robots and Signals

Another way of increasing your returns can be trading with binary robots and signals. Binary robots are special software that use complicated algorithms to find profitable trades (commonly known as signals). Depending on the adjustments and trading settings, it can also place the trade instead of the trader.

Another way of increasing your returns can be trading with binary robots and signals. Binary robots are special software that use complicated algorithms to find profitable trades (commonly known as signals). Depending on the adjustments and trading settings, it can also place the trade instead of the trader.

Signals are trading alerts that contain all necessary information about a trade that has a high profitability potential. For example, traders get a notification that contains the underlying asset, trade direction, expiry time etc. All they have to do is trade it! They can trade it automatically or manually. Learn more about signals.

Just a few years ago, binary robots and binary signals were two separate types of services, but more and more often we see different types of trading and trading services integrated on the same trading platform. Of course, before using any signals or robot trading service, make sure to check the reviews available on FFB.

Top Myths about Binary Options Trading

What is the real truth behind binary options trading? Is it all a scam? Is it really that easy? Will we all become millionaires in the blink of an eye? The truth about binary options trading is sometimes as complicated as the myths that surround it.

Here, we will debunk some of the most popular myths!

Myth no. 1: Binary Options Trading is Gambling

To people uninvolved in binary trading, logic is simple: you make an account, deposit money and make a bet whether the selected option will go up or down. This logic couldn’t be further from the truth. Experienced traders agree in one: in its possible to trade binary options and treat them like gambling, but it won’t take you far. Read more about the difference of binary options and gambling

The truth about binary options no. 1: even though some treat it like a gambling game, there is so much more to it. Relying solemnly on luck is not a solution for traders who wish to be profitable and trade in a reliable way.

Myth no. 2: Binary Options are Fast Money

Many brokers use this technique to attract traders by promising them high returns in short time. Sometimes the general atmosphere is such that it is really easy to believe that all trader has to do is make a deposit, and platform will do all by itself and make him a millionaire.

The truth about binary options no. 2: Binary options require serious engagement and knowledge of financial analysis in order to be profitable. Testimonials and advertisements that use “get rich quick” language can be considered a scam and false advertising, as they are empty promises.

Myth no.3: Binary Options Trading causes addiction

Some claim that binary options trading, just like gambling, can cause addiction. The adrenalin of short-term trading may influence some traders, but not all.

The truth about binary options no. 5: Contrary to that popular belief, binary trading experts always warn that trades should be executed only after thorough analysis. Such trading behavior significantly reduces the risks and lowers the chances for emotional or forced trading. Never invest more than you can afford to lose!

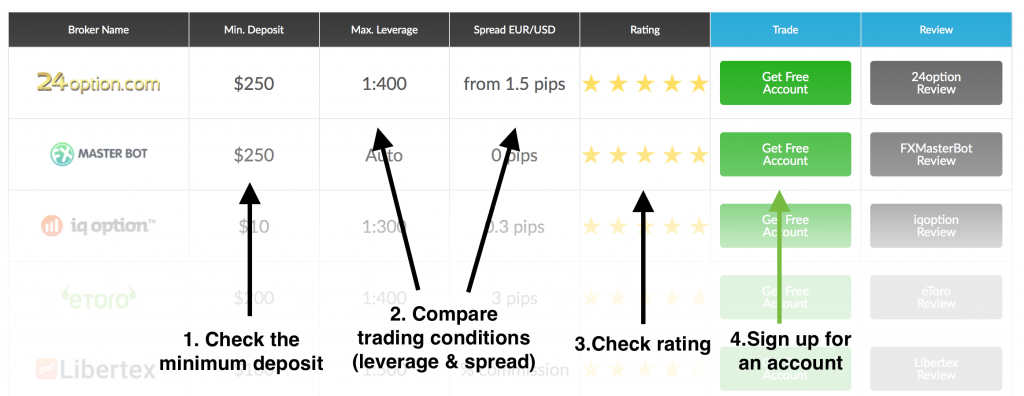

How to Choose a Binary Options Broker

Apart from ensuring a higher rate of return, most of the experts also value safety. Many brokers do offer more than 100 % of returns, but that is not objective return rate. Serious brokers offer reasonable rates and not those that sound too good to be true. The best brokers have user-friendly platforms, great customer service and a variety of trading options.

Online Trading Broker Terms & Conditions

Terms & Conditions always offer more detailed information than the website and are usually located at the bottom. If some things are still not understandable after reading T&C, better don’t deposit, but contact customer service for additional questions.

Broker Trading Accounts and Bonuses

In order to start trading, traders often choose an account type and make a minimum deposit. Account types may vary: some brokers offer five account types, other only one or two (like Nadex) and each account requires different deposit amount. Minimal deposit is the minimal amount broker accepts as a deposit when opening an account or adding additional funds to your account.

The bonus is additional amount offered by the broker to motivate the trader. Unfortunately, some scam brokers use the bonus to blackmail the traders when they want to withdraw their money. Although it is completely legal to request a certain turnover before allowing bonus withdrawal, it is not legal to add bonus without trader’s approval. Also, bonuses are not allowed with CySEC regulated brokers anymore.

The Demo Account

Demo account is probably the best way to experience binary options trading. It is a special account type that enables you trading with fictional money in order to learn how to place trades and get accustomed to the interface. Traders win no money, and they lose no money.

Trading Assets and Trading Options

Traders can choose whether they’ll trade high/low, one touch, ladder, pairs, 60 seconds, long- term, range options any many more.

The expiry times of binary options may vary from short-term (15 sec, 30 sec, 60 sec, 2 min, 5 min) to long-term (end of the day, end of the week, end of the month, 30 days or more).

The underlying assets are currencies, commodities, indices, stocks and cryptos. There are also bonds, ETFs which are more common with CFDs brokers.

Customer Support and Education

Every successful binary options trader will tell one thing to inexperienced traders: never underestimate the power of knowledge in binary options. Many good brokers offer educational materials. Customer service nowadays is usually available in many different ways. Depending on the broker, traders can contact them via phone, email, live chat or skype.

Forex and Options Trading – Deposit & Withdrawal

Forex and Options Trading – Deposit & Withdrawal

The minimum investment is the minimum amount that can be placed in one trade while depositing is adding funds to the account. Withdrawal is a process of taking money from the trading account to banking account. There is usually a limit for minimum and maximum withdrawal.There are many ways to deposit and withdraw money: bank wire, credit card, debit card, e-wallets…

Bank wire is one of the most popular ways of depositing. The most renowned banks, like HSBC, allow depositing and withdrawing from their clients’ accounts. The bank ensures all transfers are safe as do most binary options brokers. For many traders, HSBC will surely offer premium service that also covers binary trading.

Make sure to upload your documents as brokers require them to verify your identity and stop potential money laundering schemes.

Broker Regulation

Today, most serious brokers are registered with at least one of many regulating bodies. The most popular regulatory body is CySEC as it covers the territory not only of the Republic of Cyprus but the European Union as well. The EU is a great market so it’s no wonder that most of the brokers are licensed by CySEC. Read more about binary options regulators

Learn about the CYSEC investor compensation fund to see how you can get some of your money back if the broker becomes insolvent.

You can also file a complaint with the regulator in case you think you have been scammed. However, the best way to get your money back is to use MyChargeback.

Every country has its own regulator as well. Regulated brokers are obliged to respect the laws enforced by the country of registration which is a great help in case anything goes wrong, as traders have not only customers service to ask for help, but a state body as well.

Binary Options USA

Global binary options are mostly tied to brokers that operate on a different platform than the one that is allowed by the US authorities. US binary options traders can use any regulated binary exchange. This is not a bad thing, as regulated market means that customer is more protected than on many other local markets.

For binary options trading USA that is compliant to all possible versions of the rules enforced there, there is NADEX, based in Chicago, that does offer binary options trading according to US rules and regulations. You can read our NADEX review here.

What is Social Trading & Copy Trading?

Social and copy trading are new possibilities in online trading that enable traders to follow others and place trades in the same way as they do.

Copy trading can be seen as copy/paste option on a personal computer. Trader selects a peer to follow, and trades, according to their affinities and settings on the platform are directly copied. The trader can choose which peer to follow and see their trades. If the trader finds the trade promissin, then he copies it, and if not – the trade is skipped, and trades some other time. Most copy trading systems automatically copy all the trades with preset spects from selected traders one follows.

Just like any type of investment, social trading is only reliable as the platform that provides it and the traders you follow. Besides selecting a reliable platform, traders must select reliable trader to follow as well. Sometimes, losing is inevitable, but there are still many traders who understand the market and price movement and who do the great analysis before placing trades. This is a type of trader one should follow.

What is important to mention is that in most cases, copied and social trades often have a limit when it comes to investing, which means traders can place only a certain percent of their funds. This rule is existing because, trader didn’t make a projection by himself, but is simply following another trader.

Cryptocurrencies Trading Basics

Cryptocurrencies, as implied by their name are a type of digital currency that uses encryption protocols for securing, verifying and sending transactions. They achieve it by using a technology called the blockchain which resembles a public ledger that chronologically registers and validates the details of every transaction. Tokens, on the other hand, are more like a digital commodity than a currency.

Crypto trading can take place in several ways. Learn more about crypto trading.

Trading Cryptocurrencies Like Bitcoin with IQoption

IQ Option’s platform is both advanced and intuitive. It provides quotes in real time, gives the ability to trade with fiat currencies on Forex and Options as well as Cryptocurrencies on CFDs. One of the benefits of Cryptocurrency CFD trading with IQ Option is the volatility of these assets, they provide a perfect opportunity to open and close short positions throughout the day, and invest in long positions, given the current bullish trend of the crypto assets. Another great advantage of this platform is the low investment threshold – only $1. Considering the growing interest in a sophisticated, decentralized exchange, it looks like an interesting platform with promising, great additions to come soon. You can try trading cryptocurrencies now, with a free demo account.

How to Stay Safe while Trading Online?

Binary Options Certificates Scams

When deciding on a broker, traders usually visit their websites, and then they see it: a line of aligned seals signaling the broker won an award for being “the best broker”, having “the best options”, being “100% secure”, or perhaps, “top broker”. Another worrying trend we noticed is brokers displaying their “regulated certificate”, even when they are not regulated by any regulatory body. In the case of doubt, always read Terms and Conditions. Regulated brokers usually state there which body regulates them, together with their regulating number. The regulating number can easily be proofed on regulatory bodies websites. For brokers who claim to be regulated by CySEC and other institutions, do it here. You can see an example of a false regulation seal to the right.

Binary Options Certificate Scam – Example

We noticed that one of the brokers that is on our Blacklist displays such elements on its web page. All one needs to do is scroll, and right on the bottom of the CapitalOption page, three “awards” can be found.

- “100% money back guaranteed”,

- “100% quality” and

- “Certified, secure, authentic”,

Sounds pretty good, right? Unfortunately, these awards and certificates make no sense as they are all fake.

Bonus Terms and Conditions in Binary Options

Bonus rules are provided by good and bad brokers alike, so the pure existence of rules is not providing any insurance at all. The difference is that good brokers have reasonable conditions while scam brokers leave to many information open to misinterpretations or don’t have such rules at all.

The formula for calculating the trading volume is mostly explained in bonus terms and conditions.

For example, the trader makes $250 deposit, and the broker is willing to add 100% bonus with a required turnover of x20.

This means that trader has $500 available for trading, but not for immediate withdrawal. The withdrawal can happen only in case a required trading volume has been reached. In this case, the trader can withdraw bonus profit and deposit, only after the total volume of the trades placed reached $ 5,250

Deposit + Bonus x 20 = required volume

$250 + $250 x 20 = $5,250

When the trader has reached the volume, the amount (bonus profit and deposit) can be withdrawn.

Here are some examples of how brokers manipulate with bonuses to prevent you from withdrawing.

Binary Options Bonus Scams

LBinary: Unauthorized bonuses – The trader lost $10,000 in a single night, as the broker traded in her name without prior approval, and even added an unauthorized bonus. No matter how much she tried to convince her account manager and customer support to stop, it was impossible. There was no written proof of her accepting anything, and the broker simply took advantage of the customer.

MyOption: Impossible withdrawals – In this case, the trader got a bonus without knowing what the terms of bonuses are, and every attempt to contact the broker was futile.The trader was told that bonus can be canceled at any moment, and the deposit is withdrawn fully, but the reality was much different.

Very often, a bonus is used as a way to keep the trader’s deposit locked, and this is not surprising as bonuses are usually perceived as extra money that always comes in handy. According to CySEC, no regulated broker is allowed to offer bonuses. This protected many traders, but not those who are trading with unregulated brokers.

Sometimes account managers put additional pressure on traders with promotions that are potentially against the trader’s interest. Account manager and brokerage staff have a tendency to do all the convincing part via phone call, as it is harder to track what is going on, especially when it comes to scam brokers. For this reason, always insist on written correspondence via email.

Binary Options in Israel

After making conditions for registering binary options business even stricter, Israeli Securities Authority (ISA), under the leadership of prof. Shmuel Hauser has decided to make illegal all advertising and service providing in binary options industry towards Israeli citizens. The new legislation has created an unfriendly business environment so it can be expected that all brokers who are offering regulated binary options will have to stop offering such services. This means that Israeli traders will be forced to trade binary options with unregulated companies, and all that dependable on how rigorous ISA will be when it comes to prosecution of unregulated brokers.

After making conditions for registering binary options business even stricter, Israeli Securities Authority (ISA), under the leadership of prof. Shmuel Hauser has decided to make illegal all advertising and service providing in binary options industry towards Israeli citizens. The new legislation has created an unfriendly business environment so it can be expected that all brokers who are offering regulated binary options will have to stop offering such services. This means that Israeli traders will be forced to trade binary options with unregulated companies, and all that dependable on how rigorous ISA will be when it comes to prosecution of unregulated brokers.

Forex Trading in Israel

However, this ban doesn’t mean that it is impossible to experience online trading in Israel. You can still trade forex with regulated forex brokers. Forex is another popular type of online trading based on currency pair contracts that allows traders even more control and customization possibilities than binary trading.

For example, forex trade can be closed at any moment, and you don’t have to wait for the expiry time to run out. As always, make sure to find a solid Israeli forex broker. We suggest you try trading with Plus500 (80.6% of retail CFD accounts lose money), where a trader with an account can trade CFDs on Forex, Stocks, Commodities, Options and Indices”.

Binary Options in South Africa

Binary options trading became very popular in South Africa in the very beginning, almost 10 years ago, but South African government still didn’t manage to completely regulate all aspects of this type of financial trading. All aspects of investing and finances, except banking, are regulated by the Financial Services Board (FSB). One of the most interesting aspects of binary options trading in South Africa is that companies in South Africa are not allowed to offer binary trading services to South African traders. This is another reason why South Africans have to trade with offshore brokers.

Traders who want more diversity or to trade with multiple brokers should select binary options broker regulated by other important regulators like CySEC.

Forex in South Africa

Still, traders can still find a regulated forex broker and trade with popular forex brands. This makes forex trading the preferred choice by South African traders.

Most popular brokers in South Africa are Plus500 (80.6% of retail CFD accounts lose money) and CMTrading (FSB Reg no.: 38782), that offers incredible trading accounts, risk free-trades and leverage up to 1:200.

Binary Options in Japan

Binary Options in Japan are legal and regulated by Financial Futures Association of Japan (FFAJ), that not only regulates the market but also publishes reports on the binary market. As most regulatory bodies in the world are only regulation-oriented and don’t care much about the market results, this case is another proof of well-known Japanese efficiency. Just like most other regulatory bodies, FFAJ publishes reports on the scam and unregulated brokers as well.

Binary Options in Lebanon

Binary options are becoming increasingly popular in Lebanon. Also, we mentioned that it is always better to trade with a regulated broker than with unregulated. Regulated brokers are, generally speaking, safer and more reliable as they keep funds in separate accounts and allow traders an additional level of transparency and security.

In Lebanon, the main regulator for binary options is Banque du Liban, or the Central Bank. One of the main roles of Banque du Liban is providing licenses to interested brokerage houses. However, like many other regulators, Banque du Liban does little to really regulate binary options. Binary options in Lebanon are mostly based on brokers that are regulated offshore by other popular regulators such as FMA or CySEC. Traders should always check whether or not the broker has a valid license. The license number can usually be found in the footer of the website, but don’t hesitate to contact the regulator as well, as some scams publish random numbers they claim to be their license number.