Binary options scams are in essence one of the reasons Fair Binary Options came to existence. We saw a niche that has potential but is full with fraud and unethical activities. As the binary options phenomenon has grown, so have various ways fraudulent binary options brokers found to trick their customers. While regulation from the side of CySEC and other bodies such as the FSA, ASIC and others did help to bring a minimum set of standards binary options brokers must adhere to, we are still seeing widespread use of shady practices that can cost traders money. Read more about regulators in binary options.

AMF Study Reveals Many Brokers Are Not Disclosing Risks Properly

In this respect it is also fair to say that not always binary brokers are those who cause losses. Many customers are not aware of risks that binary options trading carries. As with any other form of financial speculation, short-term trading can be very risky and this is one of the reasons customers who did not attain desired results sometimes make internet noise. However, this is not only their fault, as the recent research by the French stock market regulator – AMF revealed. Sometimes these risk disclaimers get lost under loads of advertising, pushy phone calls and false promises.

Yes, Binary Options Trading is Risky

We will show some of their results in this article, along with some binary options scam tactics we encountered while reading numerous e-mails on our support mail. In short, AMF found that some binary options brokers do not follow all standards and regulatory guidelines, and that they use advertising tactics that can trick customers into believing that binary options trading is not risky or in some cases that profits are even guaranteed. As we try to improve the transparency of binary options industry, this report, along with our own experiences can be used as an excellent guide for beginners who understand the risks to binary options trading and like the fact that there is an easy way to take part in financial markets.

AMF Blacklist

As the number of traders grows, so does the number of brokers in this very competitive industry. Many of them are regulated now and are bound to provide good service most of the time. It is rarely that Fair Binary Options experienced complaints about regulated binary options brokers, however there were instances when they have managed to steal from customers. Also there are many examples of binary options brokers that we never got any complaints about.

As the number of traders grows, so does the number of brokers in this very competitive industry. Many of them are regulated now and are bound to provide good service most of the time. It is rarely that Fair Binary Options experienced complaints about regulated binary options brokers, however there were instances when they have managed to steal from customers. Also there are many examples of binary options brokers that we never got any complaints about.

See FBO Blacklisted Brokers

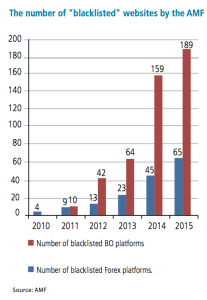

AMF reports a year to year increase in blacklisted binary options brokers that already passed the number of Forex brokers (Picture 1). However we can imagine in the relation to sheer volume traded, forex brokers are much larger entities. We also want to say that many of brokers that are on AMF blacklist actually do not exist anymore and the real number is smaller.

Binary Options Scams in Mainstream Media

It is only natural that once something becomes popular as binary options did, that scams will show up and try to take their piece of the cake. Also, considering how only few years ago regulators didn’t pay much attention to scams (but enforced more and more measures towards regulated brokers), many traders had only one solution – to contact local media and tell their story about trading with binary scams.

Of course, scam brokers are ruining the reputation of the entire industry, but at the same time, unfair and unbalanced reporting caused maybe even more harm. Media outlets were flooded by stories about binary scams and warnings not to trade binary options, without any understanding of what binary options really are and how markets work.

Such stories grew bigger and bigger, even though they didn’t apply the basic rules of journalism, but were a mere witch hunt focused on the entire industry. Unfortunately, even the big and important websites and magazines, such as Times of Israel, frequently published stories where the other side wasn’t represented at all, or where the basic journalistic principle of “5W’s +H” (answering questions like who, what, when, where, why and how) remained unfulfilled. It was common to read a story published without a single fact and without additional research on what other side has to say. Even though it is completely understandable that media is in service of people, this is a great proof how good intentions don’t have to result in fairness for everyone. By focusing on victims, journalists often seemed to forget how they are reinforcing stereotypes about an entire industry. Undoubtedly, Times of Israel helped a handful of readers to warn others about scams and raise awareness about binary options scams.

Balance is the Key in Binary Options Industry

Instead of responsible reporting, media created an atmosphere of fear, and Times of Israel even urged to support the policy of banning all binary related industries from Israel. These stories took their toll, and many brokers decided to leave Israeli territory in every way and take their business elsewhere. Considering how the new law was planning to ban customer support companies and IT companies involved in the development of binary platforms and software, this decision is not surprising.

However, after initial enthusiasm, the Israeli Knesset decided to take a summer break and now it seems that the new law will be much less repressive. However, the damage is already done, and more than a few brokers went offshore.

That scams create an unfriendly environment for a specific type of business or industry is no news. The same thing happened not only with forex industry, just a couple of years ago, but also every time some novelty occurs in our lives. It can be concluded that despite the unfriendly treatment by the media, binary options are now entering a new, more serious era, as we all witnessed many brokers being closed down due to new market regulations and rising competition.

It would also be fair to remember our readers how we witnessed regulator’s ignorance for quite a long time. Instead of focusing on the safety of traders, they were acting in typically bureaucratic manner – always passing new bills, policies, rules, and fines focused on regulated brokers while leaving unregulated entities to operate as they like. Now even regulators are becoming more proactive and even stricter when it comes to ensuring a safe trading environment for the trader.

Examples of Retail Trading Forex Scams

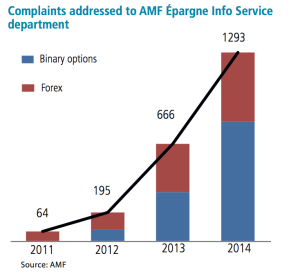

There are many examples that these scams have hit the media, especially when it comes to Forex brokers. There was a case of Joel Ward which at the time rose to become a prominent speaker on trading on Forex and even spoke on topics of ethics in trading shortly before he was arrested for taking more than $15 million of his customers, of which he lost more than $1.8 million and spent much of the rest on a huge salary, “trading retreats” and other perks. Other prominent case is that of Russell Cline, whose brokerage firm promised huge returns only to notify customers they lost all the funds. Bloomberg reported on forex scam with a firm that targeted “safety” as marketing pitch, only to destroy their Indian customers’ investment. In binary options, which is a smaller industry, scams are usually smaller, but it does not mean they hurt people who got scammed less because of that. However, AMF shows, the number of complaints is growing.

So, take a look at our 6 ways binary options can cost you money to avoid them in the future!

1. Downplaying Risk of Binary Options Trading

We have already mentioned that one of the ways binary options brokers trick customers into depositing is to downplay risks to trading. This is outright fraud since in most cases they rely on uninformed customer. This binary options scam happens even before customer deposits money. While it is normal in every business to highlight pros and hide cons, with financial investing it is a good case practice not to hide risks from the customers. One of the worst things binary options broker representatives can do is make false assurances about returns, like, “3 out of 5 trades are won” – as AMF experienced during their mystery shopper tests.

We have already mentioned that one of the ways binary options brokers trick customers into depositing is to downplay risks to trading. This is outright fraud since in most cases they rely on uninformed customer. This binary options scam happens even before customer deposits money. While it is normal in every business to highlight pros and hide cons, with financial investing it is a good case practice not to hide risks from the customers. One of the worst things binary options broker representatives can do is make false assurances about returns, like, “3 out of 5 trades are won” – as AMF experienced during their mystery shopper tests.

According to a former employee of one scam broker who decided to give an interview to Times of Israel, operators who work with such brokers are taught to talk about binary options in a specific way, in order to convince the potential trader to make a deposit:

“Guralnek says he was told to present himself as a broker who made a commission on the trades and to emphasize how much money the customer could make while downplaying the risk. In fact, rather than helping customers to make smart trades, the “broker’s” true interest was for them to make unsuccessful predictions and lose their money.”

Yes, it is easy to trade binary options operationally, but some effort is needed to master skills that will make traders better at fundamental and technical analysis. Exaggerated claims of earning $17,000 per week as we are seeing all over the internet by people who promote BinaryBoom are really over the top and in our opinion can be qualified as binary options advertising scam. Also, one former US agent managed to recover $2 million stolen by BinaryBook scam. AMF highlights various cases where risk of losing the invested money was downplayed or not even mentioned. Also, some binary brokers were found not to do any due diligence by finding out more about the customer – like asking for job, income. In some cases not even. One of the big cases was the one of R. Swannel who showed results that did not stem from actual trading. He was sued by CFTC.

No Risk in Binary Options Automated Trading?

This scam technique is extremely popular among different binary trading robots that lately pop up from nowhere. Unlike in the past when there were only few reputable binary software available, nowadays everyone who has some programming knowledge can create basic software that looks legit. Such binary software are usually accompanied with catch phrases and elaborate storylines that have only one goal – to convince you that binary trading can make you a millionaire.

Here are some of the most important characteristics of such auto trading scams:

- very little to no information about the product

- great promises about certain amounts that can be made in limited time (for example $3,765 in the first day)

- video testimonials made with (mostly bad) actors

- pressuring trader by using psychological methods of manipulation

- displaying a fake number of available spots left

We at Fair Binary Options frequently wrote about this type of scams to help traders learn the difference between the good and the bad binary trading software. For example BinaryTrustMethod is a binary scam trying to convince traders they can make $2100 daily on auto pilot.

The worst type of binary options auto trading scams are those that downplay the risk while hiding behind the disguise of expertise. Such was Professional Binary Robot scam that was hiding behind the face of prog. George, but we managed to prove how this is just another fraudster trying to take traders’ money. Even though we prevented many traders from losing money, they were also traders who din’t read our warnings and ended up scammed and broke.

2. Cold Calling – Binary Options Scam with Privacy Breach

So, you are at home one day, minding your own business when a phone rings. A guy from some company is calling you to present you with an amazing investment opportunity. He is calling from a binary options broker XX and is asking you to deposit as little as YY to earn huge returns as high as 80% or even more. This sounds interesting so you say “tell me more”. Within this call the customer will in most cases receive information that is close to the binary options scam we described in the first point.

So, you are at home one day, minding your own business when a phone rings. A guy from some company is calling you to present you with an amazing investment opportunity. He is calling from a binary options broker XX and is asking you to deposit as little as YY to earn huge returns as high as 80% or even more. This sounds interesting so you say “tell me more”. Within this call the customer will in most cases receive information that is close to the binary options scam we described in the first point.

There is another problem with this, the binary broker representative has your phone number and you have no idea from where. The same thing happens with other products so it may not ring alarm. However, the same binary options scam happens with e-mails. This is something that is not always shared in public directories as the phone number. We call this cold calling – it usually involves binary options broker who buys user lists with personal information and calls potential customers. In some cases they buy leaked and stolen databases and call customers that already trade with different brokers.

Sometimes they even go further by using the data and calling the customers as if they already made a decision to deposit. In case the person is reluctant, they simply use simple manipulating techniques and make trader think less of himself as they wonder why is he unable or unready to grab this amazing opportunity.

One woman in Cyprus was arrested, trying to sell stolen data. She was employed with a broker who reported her to the police after suspicious behaviour. She will press charges soon. Read more about this interesting case.

One of the most interesting cases that involved cold calling was the one regarding SW1options broker. SW1options scam called a man, out of the blue. The man, who never took interest in binary trading before, quickly understood that there is no chance it will be possible to achieve returns promised. He simply declined the offer but warned British media about it. What happened later involves unlicensed business operations, false claims, and promises, and offshore account. Read more about SW1options binary scam.

We have had several situations where our own staff received e-mails from companies that they never signed up with. This is extremely bad since people must trust a broker when they promise to keep their information private. This way these scammers are destroying the reputation of the broker where they got the data and the whole industry. We already blacklisted some binary options brokers for this. Traders can see which ones are we talking about in our black list.

3. Hidden and unclear Terms & Conditions stipulations

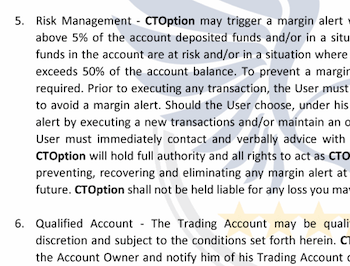

This is a very broad area but we will try to explain this on an example, while other examples can be found in parts of this article discussing bonuses, withdrawal processing problem, etc. Recently a customer sent us an e-mail about not being able to withdraw profits from CTOption. We contacted the broker and they cited part of their T&C that mentions some 5%. This rule is not mentioned under section on withdrawals. In any case, the rule gives the broker right, according to T&Cs they wrote, that if the trader invests more than 5% of total capital in a trade, they have the right to stop the withdrawal for reasons that something suspicious is going on. This is the simple version of a very confusing paragraph in their T&Cs, that can be found on page 9.

This is a very broad area but we will try to explain this on an example, while other examples can be found in parts of this article discussing bonuses, withdrawal processing problem, etc. Recently a customer sent us an e-mail about not being able to withdraw profits from CTOption. We contacted the broker and they cited part of their T&C that mentions some 5%. This rule is not mentioned under section on withdrawals. In any case, the rule gives the broker right, according to T&Cs they wrote, that if the trader invests more than 5% of total capital in a trade, they have the right to stop the withdrawal for reasons that something suspicious is going on. This is the simple version of a very confusing paragraph in their T&Cs, that can be found on page 9.

Let us try to make this easier to understand – if a trader deposits $250 which is minimum with CTOption (under investigation), and invests the standard, at some places minimum $25 in a trade, the broker automatically has reason to stop withdrawals. So, only $5 trades, for 60 second trading are allowed. We see this as vey unethical and we have asked the responsible person about this, but never got an answer. T&Cs should not be a way for brokers to legitimate everything they do. We consider this a binary options scam. You will be able to read more about this on our blacklist soon. We also encountered T&Cs saying that initial deposit has to be traded at least once, and others where withdrawal is not allowed a month after last deposit.

Scam Brokers without Terms and Conditions

Some traders will find it interesting how there are brokers that support forex and binary options trading, or even binary trading robots that have no terms and conditions at all!

It is completely understandable how some may say that terms and conditions are completely redundant, especially nowadays when we must accept terms and conditions for every service, product etc. In case of any form of trading, make sure to take a good look at terms and conditions as they often help to tell a good broker from a bad one.

Some scam brokers simply don’t have terms and conditions, they are impossible to find or the link gets redirected to the homepage. Also, sometimes they copy terms and conditions belonging to another broker, and use them as their own. Scams are so careless that they live the name of the broker they stole from.

Serious terms and conditions are not few paragraphs that could have been written by a 1st-grade student. They are legal documents and they define every situation that may occur. Also, they are written in easy to understand way without any ambiguous sentences that can be translated in whatever the broker finds suitable. Also, keep in mind that every type of service, promotion, financial transaction etc. has to be described in terms and conditions.

ESMA and CySEC both took this issue seriously, especially regarding binary options bonuses that were the main tool of manipulation when it comes to funds. Their worry resulted in the termination of all bonuses offered by regulated brokers, and ban of any bonus offerings in the future. Unfortunately, this didn’t prevent scams to use terms and condition (or lack thereof) to practice unethical behaviour. Read more how binary scams use false data and vague terms and conditions to take your money.

4. Managed Accounts

Many binary options brokers offer 1-on-1 sessions, personal account managers and more to make their traders feel special by providing them with personalized care. However, we do not think it is ethical for brokers to offer managed accounts to clients. At this point, big part of binary options industry works in a way that broker takes the other side of the trade. It is a risk for the binary broker, however, if they found a customers, by doing 1. point, they have the upper hand. In this respect it makes no sense that anyone from that broker trades with the funds of the customer, since they have interest for customer to win. This is why we urge all customers never to cede the control of their account to account managers, senior analysts etc. They will mostly try to get traders to deposit more for this perk. In our experience, the broker first scores some winning trades, before something goes wrong, as did with the funds of this customer who lost $10,000.

Many binary options brokers offer 1-on-1 sessions, personal account managers and more to make their traders feel special by providing them with personalized care. However, we do not think it is ethical for brokers to offer managed accounts to clients. At this point, big part of binary options industry works in a way that broker takes the other side of the trade. It is a risk for the binary broker, however, if they found a customers, by doing 1. point, they have the upper hand. In this respect it makes no sense that anyone from that broker trades with the funds of the customer, since they have interest for customer to win. This is why we urge all customers never to cede the control of their account to account managers, senior analysts etc. They will mostly try to get traders to deposit more for this perk. In our experience, the broker first scores some winning trades, before something goes wrong, as did with the funds of this customer who lost $10,000.

One of the most famous cases of a scam involving managed accounts is the case of uTrade and their controlling shareholder Aviv Talmor. Mr. Talmor was prosecuted by Israeli authorities for misleading around 600 clients in the period from 2012 to 2015. According to the accusations, Talmor was using false advertising when trying to persuade people to do business with him. He was managing their money, without the license necessary to do that kind of business necessarily.

More about regulation of binary trading

ISA is also persuaded that every trader was presented with an account that contained only imaginary money, while at the same time, the real money was deposited to another account controlled by the company. This accrued 12 million USD difference between the fake accounts and the real cash that was being held in the uTrade bank account. So, according to this case, Talmor provided account management without having necessary license, mislead traders in the very beginning, used fraudulent ways like fake accounts to motivate traders to invest even more, and held their money in the special account, unavailable to traders. Keep this in mind before accepting any offers for account management.

If Tommy and Ronald Rutgersson knew this information, this would save them €100,000 they lost with SecureOptions scam. The two brothers first god a cold call by a flirty agent who convinced them to make a nice and big deposit. Then, they communicated with their 3 managers and, unfortunately lost all their money. This also proves that account management is not limited to allowing someone else to trade for you, but it also comes in different forms such as advice by ‘trading experts’ who put their own interest in the first place and basically know nothing about trading strategies.

5. Bonuses as Binary Options Scam

As of December 2016, CySEC regulated brokers can no longer provide binary options bonuses!

Bonus terms and conditions are one of the most frequent cases we get. All brokers offer bonuses and that is fine for the most part. The crucial thing is that the customer understands the terms and conditions and accepts them. In most cases, bonuses are a great way for traders who understand what they are doing to score well, however, many traders do not understand terms and conditions. We think brokers need to explain this to binary options traders before they get a chance to accept it. Recently we also wrote about the stand that CySEC made about the matter. In short, traders should be informed and binary options brokers should make sure to get the acceptance of a bonus in written.

We at Fair Binary Options will not accept any explanations that the customer said yes over the phone. We think brokers should make sure the bonus is accepted in some sort of written form – as regulator requests in order not to be seen as binary options scam. It is just a small effort. Also, turnover rules must be confined to bonus alone and not include deposited money. We want to warn all traders here that widely accepted practice, after bonus was received, is that all trades that end in the money are counted as bonus profits, while all trades that are lost are subtracted from the money deposited by the trader. This is an unfortunate rule that everyone should be aware of.

Still, brokers who don’t operate under a license are under no obligation to respect CySEC directives or regulatory guidelines by any other government body. This means that they operate in an area that leaves traders unprotected, which is a fertile ground for many scam brokers. This doesn’t mean that all unregulated brokers are scams, but traders should still be careful and research brokers before making a final decision (and initial deposit in the end). Here you will find 3 binary scams you should definitely avoid!

6. Refusal to Process Withdrawal

This is one of the worst binary options scams, the one that usually is the last step, before regulators or sites such as Fair Binary Options get involved. There are some cases when traders just do not understand the procedure and everything gets solved after their ID verification documents are submitted. This is not a binary options scam. ID verification is important for binary options brokers, showing they obey AML regulations – you can read more about it in our post on money laundering. If this was done, than problems involve bonus terms and conditions as well as other types T&C restrictions.

In most of these cases, binary options brokers do not answer calls, do not return emails. Sometimes their support personnel just quotes T&C without any connection to the case or claims that bonus turnover has not been reached when in fact it has. There are many ways to do this. In most cases, if it is really a binary options scam, the broker will not return calls and in many cases they ask for more money to be deposited. In some cases, scam brokers make it hard, probably hoping the customer will give up. Since we cannot see all the volume of scams in the industry, we cannot tell how many people give up. AMF noticed this too

“It is sometimes necessary to insist in order to receive a promise of withdrawal over the telephone, but not without being asked, once again, to add more funds or send a bank card number. Some sites use the same sales techniques as when the account was opened to dissuade the client from withdrawing their funds.”

The already mentioned former employee of a scam broker explained how the basic practice is to keep the customer waiting. Withdrawal process would take extremely long amount of time during which the customer would be convinced to make further investments. In case the trader is persistent to get his money back, things take ugly turn:

“…very often the company would stop taking their calls, or send them an email saying ‘we suspect you of fraud’ and freeze all their funds. Because the customer didn’t know the real name or location of their salesperson, “they had nowhere to turn to get their money back,” explains Guralnek.

Scam brokers are often registered in one country, have their funds located in another, and customer support in third. This way, the customer is left confused and helpless in case something goes wrong.

One day, FBO team received an email sent by a reader who encountered exactly this type of scam. The trader made a deposit with BinaryDas, and then lost all his money, all because of their ‘risk-free’ trades. His designated manager simply downplayed the risk. Our reader was determined to balance out his losses, so made another deposit. He managed to achieve incredible profits, but as soon as he wanted to withdraw, he was informed how that is impossible. They made different claims: how his account is under investigation and how he has to pay a hefty fee. As it turns out, he was not the only one, as many other BinaryDas traders reported that broekr blocked their accounts as soon as they became profitable. Find out more about BinaryDas scam.

Binary Options Scams Complaints

In this article we tried to show several most common ways that people can lose their funds from unethical and fraudulent brokers. These binary options scams are actually easy to avoid if traders do their due diligence. Fair Binary Options is trying to provide the best info on binary options scam brokers as well to direct traders toward legitimate service providers.

In this article we tried to show several most common ways that people can lose their funds from unethical and fraudulent brokers. These binary options scams are actually easy to avoid if traders do their due diligence. Fair Binary Options is trying to provide the best info on binary options scam brokers as well to direct traders toward legitimate service providers.

This is not an easy task since ever more binary options brokers are entering the market and being market as a fraud by regulators (see Picture 1). In many cases our experience is good, however, later, the broker turns out to be a scam. This is where customers come in and give us info by sending us e-mails about their experiences. We try to investigate and sort things out with the broker if possible. If not we will blacklist these brokers, labeling them binary options scam.